Condo Insurance in and around Kingman

Get your Kingman condo insured right here!

Cover your home, wisely

- Kingman

- Mohave

- Arizona

- Dolan Springs

- Golden Valley

Calling All Condo Unitowners!

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm easy. As one of the top providers of condominium unitowners insurance, you can enjoy terrific service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like linens, home gadgets and souvenirs.

Get your Kingman condo insured right here!

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from a tornado, a hailstorm or an ice storm.

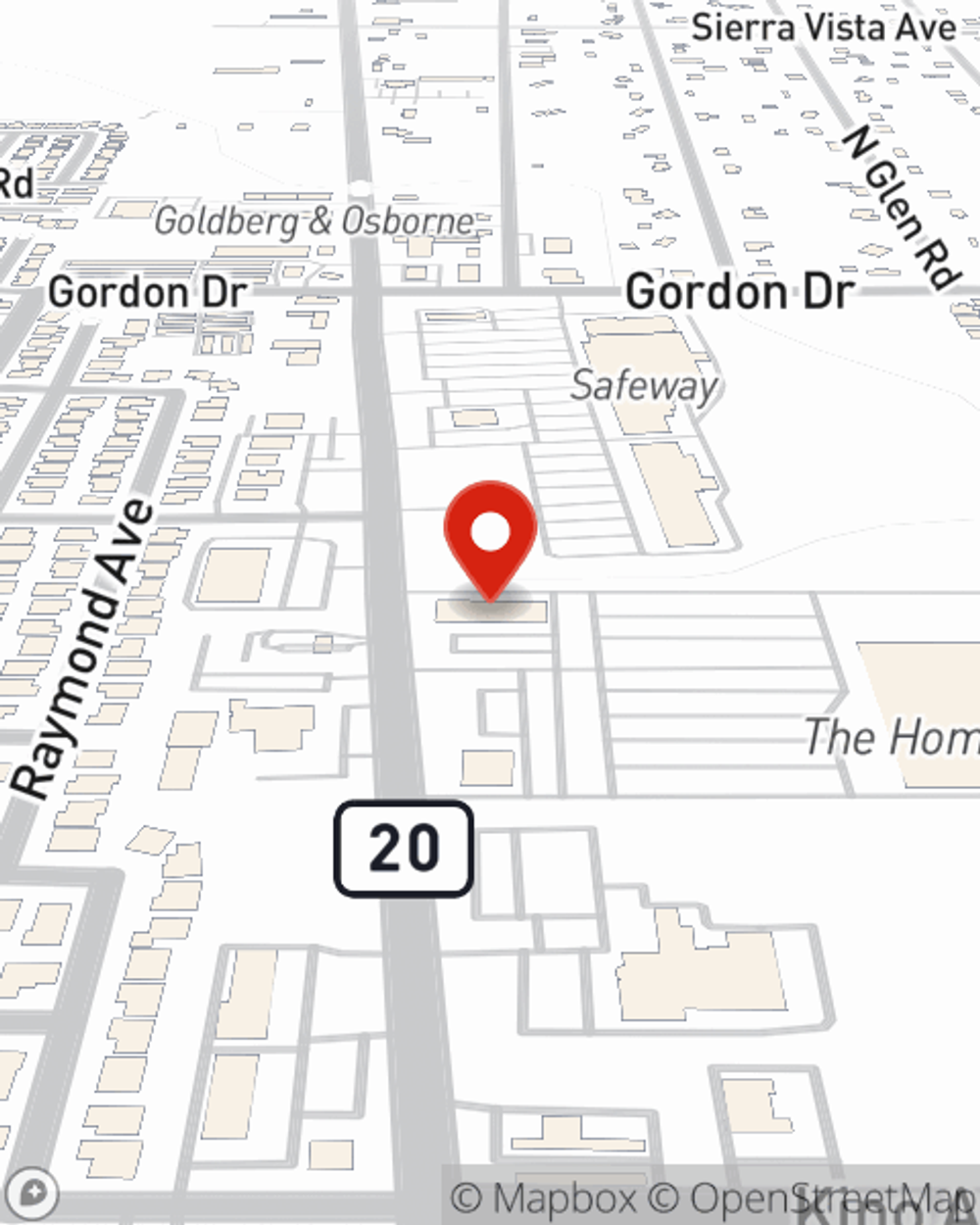

That’s why your friends and neighbors in Kingman turn to State Farm Agent Deana Nelson. Deana Nelson can outline your liabilities and help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Deana at (928) 681-8000 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Deana Nelson

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.